A quarter of customers would not use contactless over cash in the South East

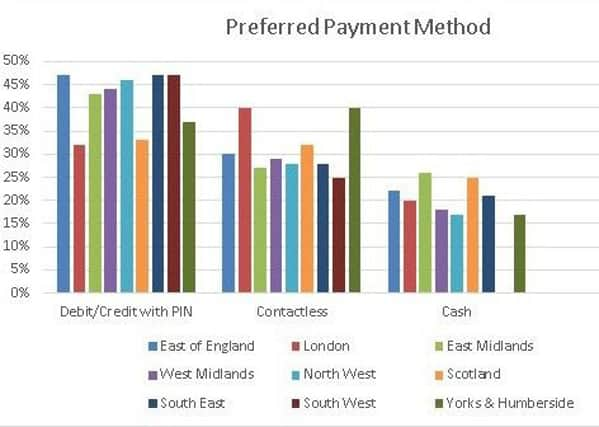

The research by Gorkana, commissioned by credit information expert, Equifax, found that a debit or credit card with a pin number is still the preferred method of payment for 47 per cent of people in the South East, compared to 42 per cent of the UK overall.

Contactless came second (28 per cent), followed by cash (21 per cent), whilst only one per cent use their phone or wearable technology.

Advertisement

Hide AdAdvertisement

Hide AdA total of 1,005 adults were surveyed online in February this year.

For 36 per cent, the speed of contactless is the benefit; 22 per cent said it was more convenient than making a trip to the cashpoint and 15 per cent think it’s more secure than cash.

The majority of consumers in the South East (73 per cent) are also happy with the current £30 contactless payment limit. However, 12 per cent would like to see it increased.

By comparison, London consumers top the table, with 21 per cent wanting to see an increase in the contactless limit.

Advertisement

Hide AdAdvertisement

Hide AdUncertainty about security could be one of the reasons that customers are holding back on contactless usage.

Recent figures from UK Finance[1] revealed that contactless card fraud hit £14 million in losses in 2017.

Lisa Hardstaff, credit information expert at Equifax, said: “Many people are benefitting from the convenience and speed of contactless. £3,913.3 million was spent in the UK in April using a contactless card, an increase of 147.6% on the previous year.

“But it could be the fear of fraud if they lose their card, or concerns about keeping track of payments that could be holding some consumers back.

Advertisement

Hide AdAdvertisement

Hide Ad“We offer consumers useful guidance in our Knowledge Centre about how to make the most of this exciting new payment technology.

“But the bottom line is, as new technology makes it easier and more convenient to spend, consumers need to step up the care they take over where they keep their cards, and how they are used.

“And they need to pay close attention to bank and credit card statements, as well as keep an eye on their credit report to watch out for any unusual – or out of control – spending.”

[1] https://www.ukfinance.org.uk/wp-content/uploads/2018/03/UKFinance_2017-annual-fraud-update-FINAL.pdf - page 8

[2] http://www.theukcardsassociation.org.uk/contactless_contactless_statistics/