Everything you need to know about Covid payouts for Eastbourne’s small businesses

and live on Freeview channel 276

Tens of thousands of small businesses across the UK could receive insurance payouts covering losses from the Covid pandemic, following a Supreme Court ruling.

Many small businesses said they should have received payouts from their insurers because Covid meant they weren’t allowed to continue operating.

Advertisement

Hide AdAdvertisement

Hide AdAccording to the report from the court case, the Supreme Court was presented with ambiguous cases of business interruption policies that insurance companies were refusing to accept. Insurers argued the business interruption policies were not designed to cover a government-imposed lockdown.

However, the Financial Conduct Authority (FCA) and the policyholder action group were supported in court and now the FCA has said 370,000 policyholders could benefit from this outcome with potentially billions of pounds being paid to businesses.

The FCA said it would now be working with insurers to ensure they ‘move quickly’ to pay claims to businesses.

Despite this outcome, local experts have said the majority of contracts with business interruption policies only cover listed diseases, which Covid-19 does not feature on, so very few successful claim can be made. Some contracts also have a geographical clause around the matter. This means the business must prove there was a outbreak of Covid-19 within a certain radius of the business which caused it to shut and therefore suffer from financial losses.

Advertisement

Hide AdAdvertisement

Hide AdAs a result of these loopholes within the contracts, it is proving much more difficult for businesses to successfully claim a payout, according to two local experts.

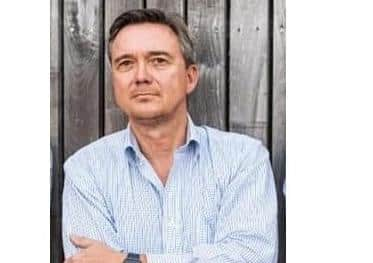

Michael Blandy, a solicitor in Hastings specialising in civil disputes, said business owners should look through their contract to see if it includes a business interruption clause at all. From there, business owners should approach their broker to review the clause and see if a claim can be made.

Mr Blandy said, “The sooner you put in the claim the better. Go to your broker for this or if that doesn’t work go to your insurance company.”

The Eastbourne Chamber of Commerce is working with GBS Insurance to see if members have a claim to make too. Peter Matthews, the chief executive officer from GBS, said he’s had around 20 cases brought to him but ‘unfortunately most instances can’t make a successful claim’ due to the details of the contracts.

Advertisement

Hide AdAdvertisement

Hide AdMr Matthews said, “Some brokers haven’t been helpful, they should be doing more and looking at the contracts to advice clients. The issue is that these policies weren’t designed to cover a pandemic.

“We’re happy to assist business owners to review their policies but they need to look for themselves first.”

He said that the presentation of the outcome of the Supreme Court case is often ‘misleading’ because in reality ‘only a limited number of businesses will be able to claim’.

Mr Matthews said, “It is very complex.”

Christina Ewbank, from the Eastbourne Chamber of Commerce, said, “I would like to commend both Michael Blandy and Peter Matthews for helping as a lot of brokers have not stepped up and haven’t helped small businesses - these two have.”

Advertisement

Hide AdAdvertisement

Hide AdFrom the claims they’re looking into, Mr Matthews and Mr Blandy are appealing to readers for information that could be the difference between a claim being successful or not:

- If you know anyone who suffered from Covid-19 before March 26 2020 within one mile of Seaside Road, they would like to hear from you.

- Any business owner who has SARS, an infectious disease, listed on the list of diseases in the business interruption clause of their policy. If enough separate cases come forward there could be a case to pursue. This will depend on the wording of your policy document but they can check it and advise you.

- If anyone is aware of any business that has had a successful claim they would also like to hear from you for more information.

Advertisement

Hide AdAdvertisement

Hide AdAnyone with information around the three points above can email [email protected] and details will be passed onto the right team to take it further.

The full report from the Supreme Court can be read here: https://www.supremecourt.uk/cases/docs/uksc-2020-0177-judgment.pdf